Super Group, the powerhouse behind Betway and Spin, has kicked off 2025 with record-breaking results. The company reported $517 million in revenue for Q1—marking a 25% increase year-over-year. For the first time in its history, the Africa and Middle East region has become its top-earning market, overtaking North America.

This marks a major pivot in Super Group’s strategy, signaling that its future growth lies in emerging economies, not traditional Western markets.

Breaking Down the Numbers: Africa Surges, North America Slows

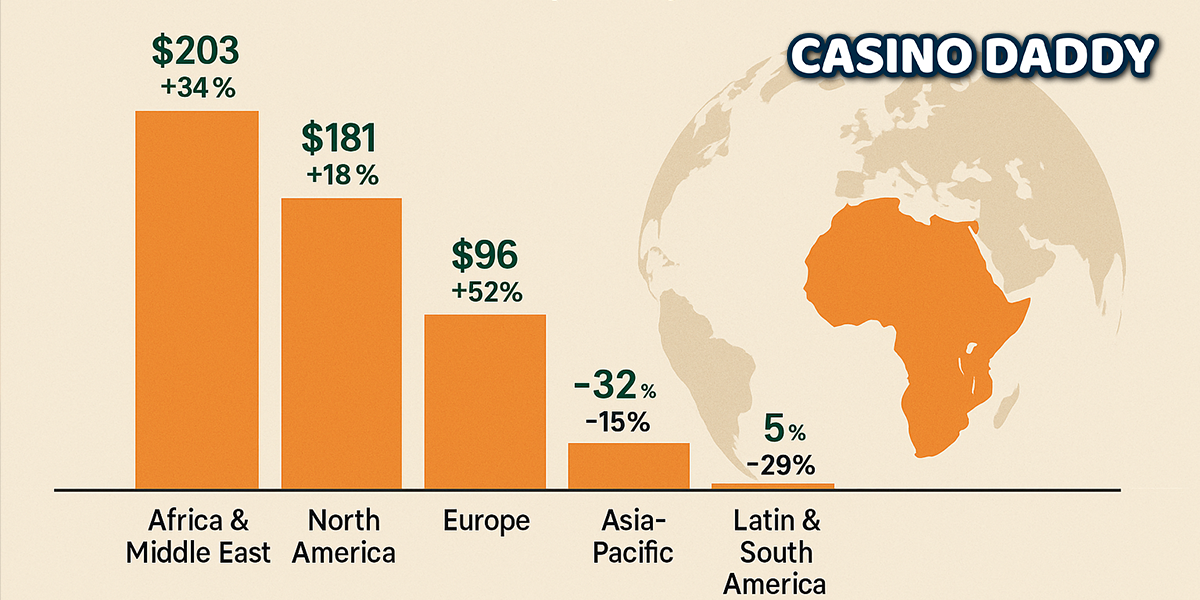

According to the latest results, Africa and the Middle East generated $203 million, a 34.4% year-on-year boost. This region now accounts for 39% of total company revenue, with South Africa playing a critical role in driving this surge.

Meanwhile, North America brought in $181 million, up 18.3% from last year. But its revenue share dropped to 35%, indicating slower growth compared to newer markets. Europe also delivered strong numbers, with revenue jumping 52.4% to $96 million.

However, it wasn’t all good news. Asia-Pacific fell 15.8%, while Latin America dropped 28.9%, suggesting either market saturation or tightening local conditions.

How South Africa Became a Cornerstone Market

Super Group’s success in Africa has been largely driven by South Africa’s online betting boom. With increased smartphone use, faster internet, and more accessible payment systems, digital wagering is gaining serious ground. These conditions have made South Africa a primary hub for the group’s operations on the continent.

Rather than shifting business from one region to another, Super Group is expanding its global footprint. Africa is no longer a side market—it’s becoming the core of its future.

Profitability Also Up Despite Fewer One-Time Gains

Even without last year’s $44 million B2B asset sale, Super Group posted impressive profit growth. Pre-tax profit soared 67.9% to $89 million, while net profit rose 31.1% to $59 million after taxes. Including $17 million from favorable currency moves, total net profit reached $76 million, a 105.4% year-on-year jump.

EBITDA climbed 46.6% to $107 million, showing operational strength across all regions. The company reaffirmed its full-year guidance of $2.01 billion in revenue and $421 million in adjusted EBITDA.

Strategic Takeaways: What This Means for the Industry

- For investors: Geographic diversification adds resilience and long-term growth potential.

- For regulators: Results highlight the economic value of well-regulated betting environments.

- For competitors: Africa is now the primary battlefield for new market share.

- For players: Expect improved platforms, more localized offers, and tailored experiences.

Conclusion: A New Global Gaming Leader Emerges

Super Group’s Q1 2025 earnings are more than just a financial milestone. They represent a clear shift in where the company is placing its bets—on emerging regions like Africa and the Middle East. As these markets continue to open up, Super Group is poised to lead the next wave of global gaming growth.

The Author

The Author

Site Admin